Write off unaffordable debt Government help can clear up to 85% of your debt

- Freeze Interest & Charges

- Stop Being Hassled & Pressured

- Write Off Unsecured Debt

Complete our simple form to get started with a Government Legislated Debt Relief Scheme. Used by over 770,000 people in 2019 alone.

Use an IVA to write off unaffordable debt

Government help can clear up to 85% of your debt

- Freeze Interest & Charges

- Stop Being Hassled & Pressured

- Write Off Unsecured Debt

Complete the simple, form to get started with a Government

Legislated Debt Relief Scheme, which over 77000 people used in 2019.

The 6 Key Benefits...

- Write off upto 85% of debt

- Interest and charges frozen

- Protect your home and car

- One affordable payment

- Stop creditor harrassment

- Legally protect yourself

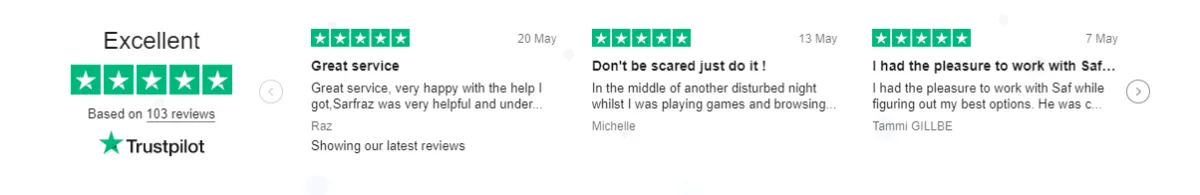

How Debt Relief Group have helped people just like you.

Here at Debt Relief Group, we provide people with the most honest and professional service. We understand how daunting it can be talking to someone about your financial difficulties; so we try to make it a stress-free process. Our mission statement; we provide Debt Solutions to people who want to put themselves back in control and start getting back on track, without the burden of debt.

The 6 Key Benefits...

- Write off upto 85% of debt

- Interest and charges frozen

- Protect your home and car

- One affordable payment

- Stop creditor harrassment

- Legally protect yourself

Which one of these debts worry you the most?

Write off most types of debt, including

Credit Cards

Payday Loans

Store Cards

Overdrafts

Personal Loans

Lines of Credits

Business Debt

Catalouges

Repayments Before & After Our IVA's Advice

Total Unsecured Debt

£20,350.00

Debt Example

Before our help

£600.00

Total contractual repayments

After our help

£120.00

Total contractual repayments

Millions of people struggle with debt.

Don't struggle with your debts in silence - regain control of your finances today! Our debt specialists can explain which options are available to you to be debt free.

You’re not alone – we've helped people manage their debts from big-name businesses.

Get your finances back under control, just think no more worrying, take control today!

Not worrying about cards being declined at the till

Not worrying about making ends meet each month

No more borrowing from friends and family

No more being trapped in the payday loan cycle

No more running out of money before payday

No more pretending everything is ok when it is not!

What Is An IVA?

An IVA is a debt solution that was introduced by the government in 1986. It enables people to become debt free in a realistic time frame (usually over 60 months). It is designed for people who are struggling to keep up with their payments but can afford to pay something towards their debts.

If you have at least £5,000 outstanding, struggling with your payments but can afford to pay something each month, you may be eligible for an IVA and a portion of your debt written off.

How an IVA Works.

We will be able to assess your financial situation, find out exactly who your borrowings are with and how much for. Once we know how much you can afford to pay each month, we can identify if you are eligible for an IVA. If the proposal to your creditors is accepted, you are legally protected by the IVA and all your interest and charges will stop. As long as you complete your IVA whatever remaining debt is left would be written off and you would receive your certificate of completion.

Debt Relief. Group is a trading style of Ease Your Debts Limited who offer Individual Voluntary Arrangements (“IVA”). Ease Your Debts Limited Offers Individual Voluntary Arrangements (“IVA”) and also works with trusted partners where you are deemed to meet the criteria for an IVA you may be mentioned to one of our trusted partners. We do not administer or provide advice solely relating to debt management products, such as Debt Management Plans. We do not currently offer advice relating to Scottish Insolvency Solutions such a Protected Trust Deeds, Debt Arrangement Schemes or Sequestration.

Michael Leslie Reeves is authorised to act as an Insolvency Practitioner in the UK by the Insolvency Practitioners Association – No 7882, Data Protection ZA455270. Registered Address – 145 Lea Gate, Bradshaw, BL2 4BQ.

The Money Advice Service is an impartial service set up by the Government. They provide free debt counselling, debt adjustment and credit information services.

© 2020 - Debt Relief Group. All rights reserved.